Do You Practice Safe Checks?

It should come as easily as airline safety, so buckle up for this one! Despite the fact that check use has declined by 25%, reports of check fraud have soared. In fact, they've nearly doubled since 2021. 1 With criminals becoming more sophisticated, it's crucial to stay vigilant and protect your financial information. We can assure you that CNB St. Louis Bank is always committed to helping our customers use their checks safely.

Protect Your Money and Checks!

Remember, every time you write a check, you expose personal information, such as your name, contact information, and bank account number. Here are some tips to keep in mind to practice check safety:

- Use Permanent Gel Pens: Protect yourself by using permanent ink when you write a check.

- Avoid Blank Spaces: Make sure you fill out every blank space on a check so criminals can't fill them in instead.

- Withhold Personal Information: Don't add personal information like your Social Security number, driver's license details, or phone number to your checks.

- Review Accounts: Monitor your account activity online or in the CNB St. Louis Bank mobile app as attentively as you await a safe arrival message from a loved one. Regular reviews ensure you quickly notice anything out of the ordinary.

- Check Your Checks: Regularly review your paid checks online and in our app. Ensure the endorsement is correct and reflects the intended payee and amount to guard against fraud.

- Use Digital Payment Options: Consider reaching out to our Treasury Management team to learn more about our Online Bill Pay and Positive Pay products.

- Follow Up: Make sure to follow up with payees to confirm they've received and deposited your check.

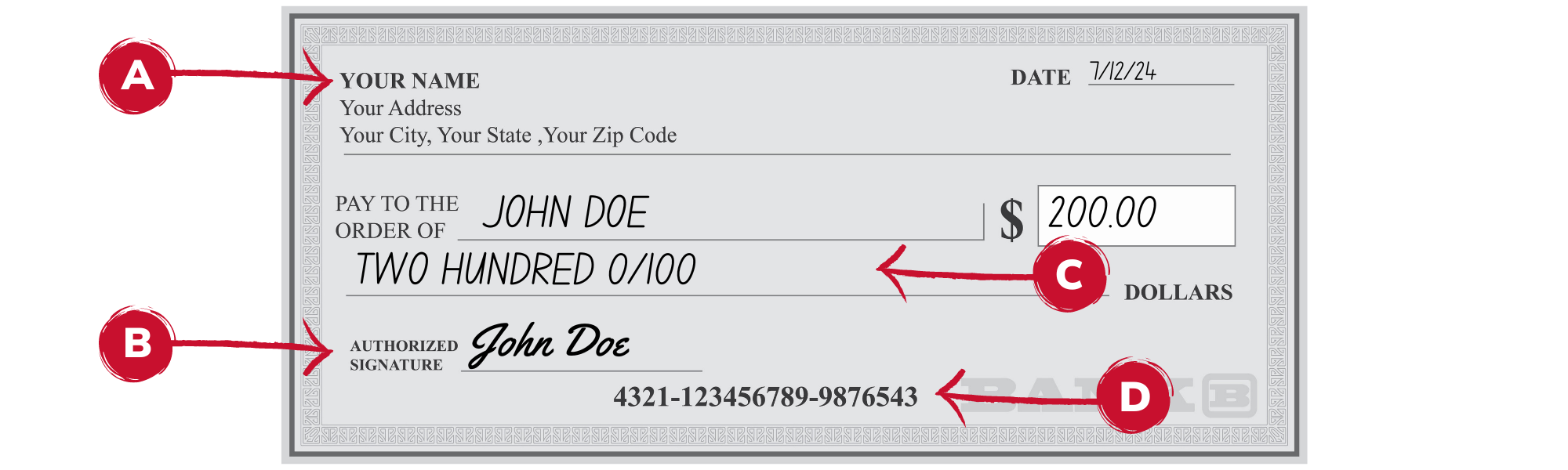

Unprotected Checks Are a Criminal's Friend!

.png)

- A: Your name and contact information can be taken.

- B: Your signature can be stolen to forget other documents.

- C: Black spaces could leave room for alterations.

- D: Account and routing numbers can be stolen.

Suspect Fraud? Do This.

- Contact your bank immediately: Report the fraudulent check to your bank. They can help stop payment, freeze your account if necessary, and guide you on the next steps.

- File a police report: Contact your local police department to file a report. This creates an official record of the fraud, which is useful for investigations and claims.

- Review your accounts regularly: Monitor your bank and credit card statements closely for any unauthorized transactions. Report any suspicious activity immediately.

- Report suspicious activity immediately: If your check was stolen in the mail, report it to the United States Postal Inspection Service at uspis.gov/report or call 1-877-876-2455

Learn More About Banking Scams

Learn more about phishing and ways to avoid being a victim of phishing by following along with CNB St. Louis Bank on social media or go to www.banksneveraskthat.com for all the tips and tricks!

We're Here to Help!

If you are unsure about phishing or have any questions, end the call, and give us a call back at our direct line (314) 645-0666 to verify you are speaking with a member of our local CNB St. Louis Bank team.

References:

- 1 2024 Findings from the Diary of Consumer Payment Choices, Federal Reserve Financial Crimes Enforcement Network, Suspicious Activity Report Statistics