CNB's EscrowManager, powered by ZEscrow, will automate your commercial escrow processes. No more concerns about tracking complex deposit flows from multiple customers, clients, or members.

What are the Features of EscrowManager?

24/7 Online PlatformYour customers and you can quickly and easily see account balances, interest paid and all disbursements—anytime, anywhere.

|

Full Digital Access For AllAll three parties—your organization, customers and CNB St. Louis Bank—are connected online. So every transaction—such as making a deposit—is automatic and seamless.

|

Automated eStatementsGet a complete picture of each customer’s account activity, with no effort on your part.

|

Simplified ManagementCreate, close, and monitor subaccounts easily.

|

On-Demand ReportingGet full visibility into your commercial escrow account—including by subaccount—whenever you want.

|

Precise Interest SplittingSo interest is calculated and paid accurately to each customer’s subaccount.

|

How does EscrowManager work?

When you think of an “escrow account,” you might think first of mortgage escrow, where the home lender holds mandatory payments collected monthly for real estate taxes, homeowners insurance and private mortgage insurance until disbursement.

Commercial escrow is different: it’s a specialized deposit account that an organization opens with a financial institution like CNB St. Louis Bank to hold and manage funds for a variety of purposes on behalf of its customers, clients, or members.

A commercial escrow account connects three parties: your organization, your customers, and CNB St. Louis Bank.

.png)

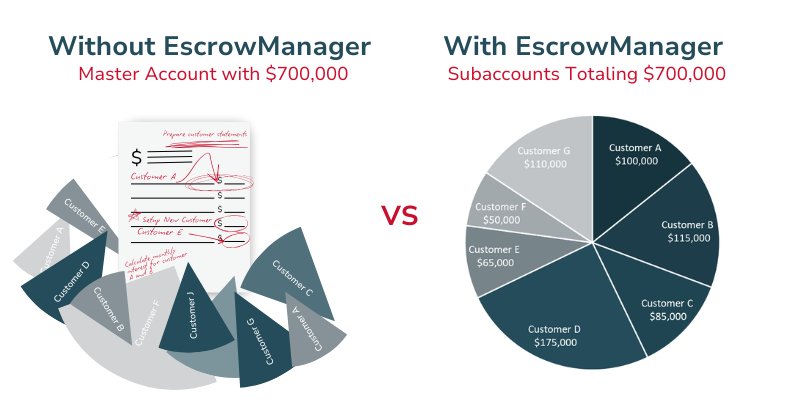

The account is divided into “subaccounts,” one for each customer to keep the funds separate. We collect, hold and disperse funds as specified by the escrow agreement, while complying with all regulatory requirements every step of the way.

.png)

A great example is a 1031 Exchange, where we hold the funds generated from a property sale. All account activity is easily visible to all parties: the title company, seller, and bank.

Who can use EscrowManager?

Many organizations benefit from commercial escrow accounts. This service is a proven way to manage complex deposits for a variety of institutions, including:

- Non-Profits

- 1031 Exchanges

- Title Companies

- Attorneys/Law Firms

- Real Estate Offices

- Municipalities/Government Entities

- HOA's

- Assisted Living Facilities

- Funeral Homes

- & Many More!

Virtually any organization that collects and manages funds for its customers, clients or members can benefit from a commercial escrow account at CNB St. Louis Bank.

Commercial Escrow. For You.

If you need to collect and manage funds for multiple customers, clients, or members, make it easy with our online commercial escrow services. You’ll not only help yourself, but also our community as we lend those dollars to your neighbors to grow businesses, own homes and build a better life. It’s just one more way we’re Banking. For You.

* Required fields

Congratulations!

You Are On the Way to an Automated Commercial Escrow Experience with CNB St. Louis Bank.

Thank you for your interested in EscrowManager! A member of our team will be in touch shortly to answer your questions and, if EscrowManager is right for you, we will usher you through your EscrowManager setup and configuration.

We are here to help, every step of the way!

*CNB St. Louis Bank Commercial Deposit Account Required. Don't have a commercial checking account with us?

Learn more about our commercial account options.

Learn more about our commercial account options.

%20(20).png)

.png)